SECTION 179 TAX INCENTIVE

YOU MAY BE ELIGIBLE* FOR UP TO A $1,040,000 FEDERAL TAX DEDUCTION THAT WILL:

1) Stretch your automation equipment budget by as much as 21%. Go to the calculator provided by Section179.org

here.

2) Address hard-to-fill manufacturing roles using safe, flexible and reliable Universal Robots collaborative robot arms.

Call 800-444-4831 to act quickly

Section 179 of the Internal Revenue Code allows US businesses to take a 100% tax deduction for collaborative robots and off-the-shelf software that is put into service by December 31.

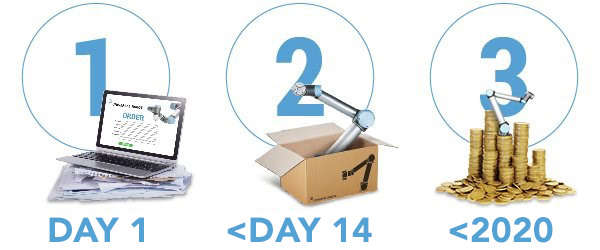

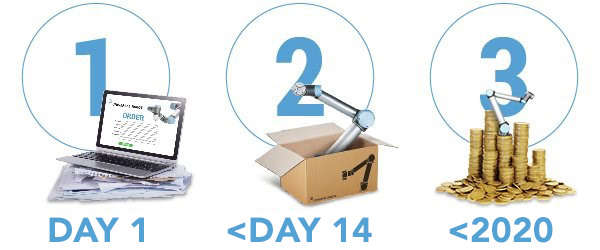

With an industry leading manufacturing process, Universal Robots assures year-end delivery for orders received and processed by December 16, 2020. You can buy, finance or lease the equipment, so talk to your tax adviser and contact HTE Automation right away.

Contact your HTE Automation sales representative at 800-444-4831 right away to make sure you can take full advantage.

*Contact your tax adviser for details.

HTE Automation is the Universal Robots Preferred Distributor in Kansas, Missouri and Central & Southern Illinois.